How we’re leveling the playing field for the trucking industry

Sentry Government & Regulatory Affairs partners with state trucking associations to advocate for legislative fixes addressing legal reform

By John Cronin – State Government & Regulatory Affairs Manager, Sentry Insurance

As a member of the Government & Regulatory Affairs team at Sentry, I’m working to shape a more fair and predictable judicial environment for the trucking industry in response to increasingly troublesome plaintiffs’ bar tricks and tactics.

We collaborate with the American Trucking Associations (ATA) and state-level associations, providing data-driven insights and building relationships to advocate for critical issues impacting trucking businesses.

Previously, our team shared with you our initiative on seeking legal system abuse reform. Here are some of our latest efforts to continue to support fleet owners.

Advocating for limits on noneconomic damages

Noneconomic damages refer to the sum a claimant is awarded for an injury’s impact on their daily life. Noneconomic damages are generally awarded to a plaintiff to compensate them for pain and suffering, loss of companionship, or loss of consortia.

These damages are awarded in addition to payments made to the plaintiff for medical expenses, lost wages, or lost earning capacity. The abstract nature of noneconomic damages creates huge leeway that trial lawyers try to capitalize on to achieve huge verdicts.

These damages are often excessive and significantly contribute to nuclear verdicts, which are jury awards exceeding $10 million. Nuclear verdicts are a major threat to the trucking industry and can put a trucking company out of business in an instant.

Within the last two years, Iowa and West Virginia have enacted a noneconomic damages cap of $5 million.

We’re actively lobbying for similar legislation in other states. In Wisconsin, we supported a $1 million noneconomic damages cap that passed both chambers of the legislature before the governor vetoed the measure earlier this year.

In other states, we’re collaborating with state trucking associations to use Iowa and West Virginia’s success as a template to help get similar legislation passed.

Pushing for the Highway Accident Fairness Act of 2023

This bill would make several key improvements to the trucking legal environment. First, it would make it a federal crime under the RICO statute to stage an accident against a commercial motor vehicle, therefore increasing the legal severity and penalties.

Criminal networks of lawyers, doctors, and individuals ramming trucks have been known to engage in this activity to defraud insurance companies and their trucking insureds. (See Operation Sideswipe in Louisiana).

The bill would also require disclosure of third-party litigation funding (TPLF) agreements in actions against motor carriers. Foreign and domestic financiers use TPLF to create an asset class out of court outcomes. TPLF increases and elongates litigation to the detriment of defendants, and we know TPLF agreements are backing plaintiffs and lawyers in litigation against trucking companies.

This bill has been circulating for two sessions, and we're working to get additional congressional co-sponsors to build support.

Working to curb abusive towing practices

We recently engaged with American Property Casualty Insurance Administration (APCIA) to develop a comment letter for the Federal Motor Carrier Safety Association (FMCSA) regarding hidden and predatory fees for the towing of commercial vehicles.

The FMCSA is encouraging the Federal Trade Commission (FTC) to address these fees as part of the FTC’s proposed Rule on Unfair or Deceptive Fees. This rule looks to crack down on misrepresentation of total costs of goods and services fees by omitting mandatory fees from advertised prices.

ATA Mid-Year Management Sessions recap

The ATA’s Mid-Year Management Session attracts trucking’s key players— trucking company owners, state association executives, and ATA staff—and gives Sentry the opportunity to discuss with them the most critical legal system issues facing the trucking industry, including:

Legal system abuse reform

Billed vs. paid medical bills

Collateral source rule

Seat belt admissibility

Failure to equip optional equipment

Noneconomic damages caps

At these sessions, we exchange information on what’s working and what’s not, and what material we can re-package to try to make a difference in states where we haven’t yet found success.

And our combined efforts are working.

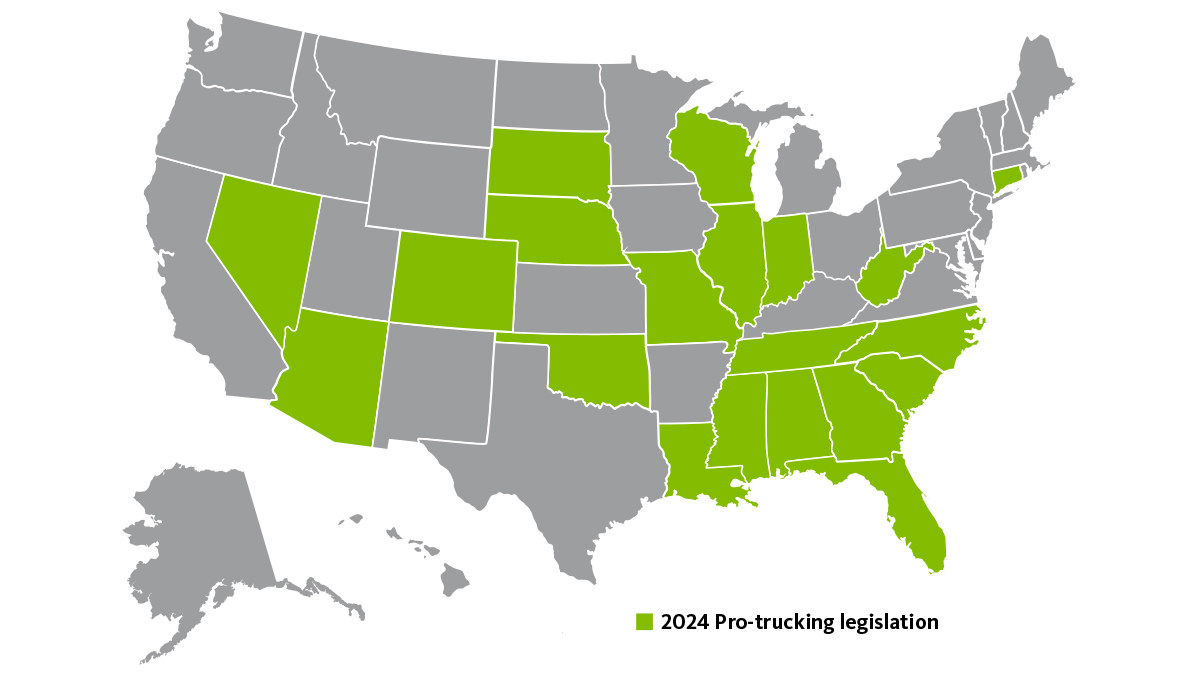

Through 2024, the states shown on this map have all introduced or enacted legislation that works to reform legal system abuses that would have an outsized impact on the trucking industry. Even 10 years ago, this map wouldn't have existed. At that time, no one was paying attention to this type of reform legislation.

With the ATA, state trucking associations, and insurance groups like the APCIA, we’re creating a legal environment that’s more supportive of the trucking industry.

The information contained in this document is of a general nature and is not intended to address the circumstances of any particular individual. IT IS DISTRIBUTED “AS-IS,” WITHOUT ANY WARRANTIES. NO MEMBER OF SENTRY INSURANCE GROUP WILL BE LIABLE TO ANY PERSON OR ENTITY WITH RESPECT TO ANY LOSSES OR DAMAGES CAUSED, OR ALLEGED TO HAVE BEEN CAUSED, DIRECTLY OR INDIRECTLY BY THIS DOCUMENT, REGARDLESS OF WHETHER SUCH CLAIM IS BASED ON CONTRACT, WARRANTY, TORT (INCLUDING NEGLIGENCE AND FOR PROPERTY DAMAGE AND DEATH) OR OTHER GROUNDS.

Property and casualty coverages are underwritten, and safety services are provided, by a member of the Sentry Insurance Group, Stevens Point, WI. For a complete listing of companies, visit sentry.com. Policies, coverages, benefits, and discounts are not available in all states. See policy for complete coverage details.

Collaborating to strengthen the trucking industry

Together, Sentry and the American Trucking Associations offer a robust support network for trucking companies, large and small.

About John

John Cronin is a State Government & Regulatory Affairs Manager at Sentry Insurance, supporting the central region of the U.S.

Related resources

Specialized trucking resources

Our industry experience lies in delivering specialized insurance solutions, safety programs, and retirement planning for the trucking industry.

A 101 guide to protecting your employees

Enhance employee satisfaction and loyalty by providing comprehensive programs, services, and insurance options.

Other ATA articles

Advocating for legal system abuse reform

The Sentry Government & Regulatory Affairs team advocates for legal system abuse reform to help protect the trucking industry. Learn about our progress at the federal and state levels.

Timely claims reporting helps protect your business

The trucking industry faces mounting challenges from rising insurance costs driven by legal system abuses and varying state negligence laws. Learn how prompt claims reporting can help protect you and your fleet.

Crash management for drivers

This guide outlines essential crash response steps for truck drivers and fleet owners, focusing on driver safety, minimizing downtime, and reducing liability. Knowing what to do if an accident occurs can help you reduce losses and maintain your reputation.